Payday Loans Increase SNAP, Reduce Child Support Payments

by Brian T. Melzer, Kellogg School of Management, Northwestern University

There has been considerable debate about whether payday lending alleviates or exacerbates financial distress. On the one hand, payday loans can help a family weather shocks to household income or expenditures. Many argue, however, that these high-cost loans lead to greater financial difficulties in the long run.

In ongoing research funded in part by a 2012 Center for Poverty Research Small Grants award, Brian T. Melzer finds that low-income households with access to payday loans are more likely to use transfer programs like the Supplemental Nutrition Assistance Program (SNAP), and also to forego child support payments.

Key Findings

- Within states that prohibit payday lending, households with access across the state border are 12% less likely to make child support payments, and are 16% more likely to use SNAP. Over time, SNAP use in border counties rises with the prevalence of payday lending.

- These differences do not reflect general economic disadvantage, as border counties have lower unemployment and slightly higher per capita income.

- Though border counties differ in racial composition – they have fewer African Americans and fewer Hispanics – the main findings hold within racial subsamples, which suggests that pre-existing racial differences do not account for the main results.

Payday loans are small, short-term loans that evolved as check cashing businesses began to advance funds against personal checks. The payday lending industry emerged in the 1990s, and by 2006 had expanded to 25,000 lenders, growing in volume from about $8 billion in 1999 to over $40 billion in 2004.

In a typical transaction, a borrower receives $350 with a promise to pay back $400 in two weeks. In practice, payday loans are used for much longer periods than two weeks, since borrowers commonly renew or roll over existing loans.

In principle, access to credit can benefit households by allowing them to fund important expenditures during financial emergencies. There is evidence, however, that borrowing through payday loans leads to difficulty paying basic household expenses and, in extreme cases, personal bankruptcy.

This study provides further evidence that payday lending exacerbates distress, but also shows that others outside the payday borrower’s household share the financial burden. Specifically, borrowers turn to tax-funded transfer programs like SNAP, and also prioritize payday loan payments over child support obligations meant to support children who no longer live with them.

Hardship, SNAP and Child Support

This study uses data from the Census Bureau’s Survey of Income

and Program Participation (SIPP), covering 1991 through 2007. The

data include information on economic hardship, the use of SNAP,

child support payments, as well as detailed geographic

information used to measure households’ proximity to payday

lenders.

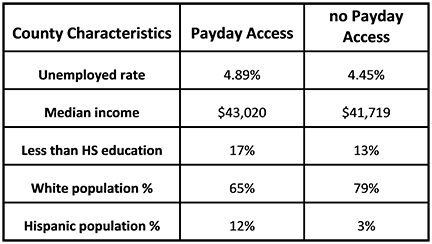

This study measures differences in economic hardship, SNAP use and child support payments between “Payday Access” counties—those within 25 miles of a payday lender-allowing state—and counties without payday lenders nearby. This research focuses on eight states that prohibited payday lending during the sample period: Connecticut, Georgia, Maryland, Massachusetts, New Jersey, New York, North Carolina and Vermont.

Payday Access Counties

At the county level, Payday Access counties on average have a 4.5

percent unemployment rate and $35,500 per capita income compared

to 4.9 percent and $34,400 among non-access counties. Among the

SIPP respondents themselves, households with Payday Access also

have higher monthly income ($2,100 vs. $2000), higher rates of

home ownership (58 percent vs. 46 percent) and slightly lower

rates of unemployment (5.4 percent vs. 5.5 percent).

Disparities in racial/ethnic composition are more striking, with fewer minorities in Payday Access areas: the proportion of African American households in Payday Access counties is 14 percent, compared to 19 percent in counties without access. The proportion of Hispanic households in Payday Access counties is 3 percent, compared to 12 percent in counties without access.

Payday Loans and Hardship

The SIPP collects information about difficulty paying mortgage,

rent and utilities bills as well as other hardships such as

inability to afford food and health care. Payday Access had

little effect on hardship in 1992 and 1995, prior to the

emergence of payday lending. However, among 2003 and 2005 survey

respondents, households with Payday Access were 7.6 percentage

points (2003) and 4.9 percentage points (2005) more likely to

report some form of financial hardship. Differences in

food-related hardship, such as cut meals, were statistically

insignificant.

SNAP Participation

The Supplemental Nutrition Assistance Program (SNAP) is an

important source of support for households in the income range

typical of payday loan borrowers. According to the USDA, SNAP

served over 46 million people in 2012 at a cost of $78.4 billion.

To qualify for SNAP, a household must have monthly income below

130 percent of the Federal Poverty Level, and less than $2,000 in

assets.

SNAP use is higher among SNAP-eligible households with Payday Access. Among these households, SNAP receipt is 5 percentage points more prevalent in Payday Access areas, which is a 16 percent increase relative to the average take-up of 31.5 percent. As with general hardship, it is only in the early to mid-2000s, when payday lenders were prevalent, that Payday Access predicts greater rates of SNAP usage.

Child Support and Payday Access

Child support payments constitute one third of income among

families living below the poverty line who receive child support.

While payments are legal obligations and not dischargeable in

bankruptcy, unpaid child support is a big problem: the federal

Office of Child Support Enforcement reported total child support

debt of $108 billion as of 2009.

Though the requirement to pay child support does not seem to vary with payday loan access, delinquency does. Households with Payday Access are 9.5 percentage points less likely to report paying as required. Reports from child support recipients confirm this difference; in Payday Access areas, the likelihood of underpayment increases, particularly when the payer lives nearby and also has access payday loans.

Meet the Researcher

Brian Melzer is an Assistant Professor of Finance at

the Kellogg School of Management, Northwestern University. His

research interests include household finance, financial

institutions, real estate and corporate finance. He has also

studied the investment choices of heavily indebted homeowners and

the effects of unemployment insurance on mortgage default.